The Single Strategy To Use For Tulsa Bankruptcy Consultation

The Single Strategy To Use For Tulsa Bankruptcy Consultation

Blog Article

Top-rated Bankruptcy Attorney Tulsa Ok Can Be Fun For Everyone

Table of ContentsThe Single Strategy To Use For Tulsa Ok Bankruptcy AttorneyOur Tulsa Debt Relief Attorney StatementsRumored Buzz on Bankruptcy Attorney TulsaFascination About Bankruptcy Attorney Near Me Tulsa7 Simple Techniques For Affordable Bankruptcy Lawyer Tulsa

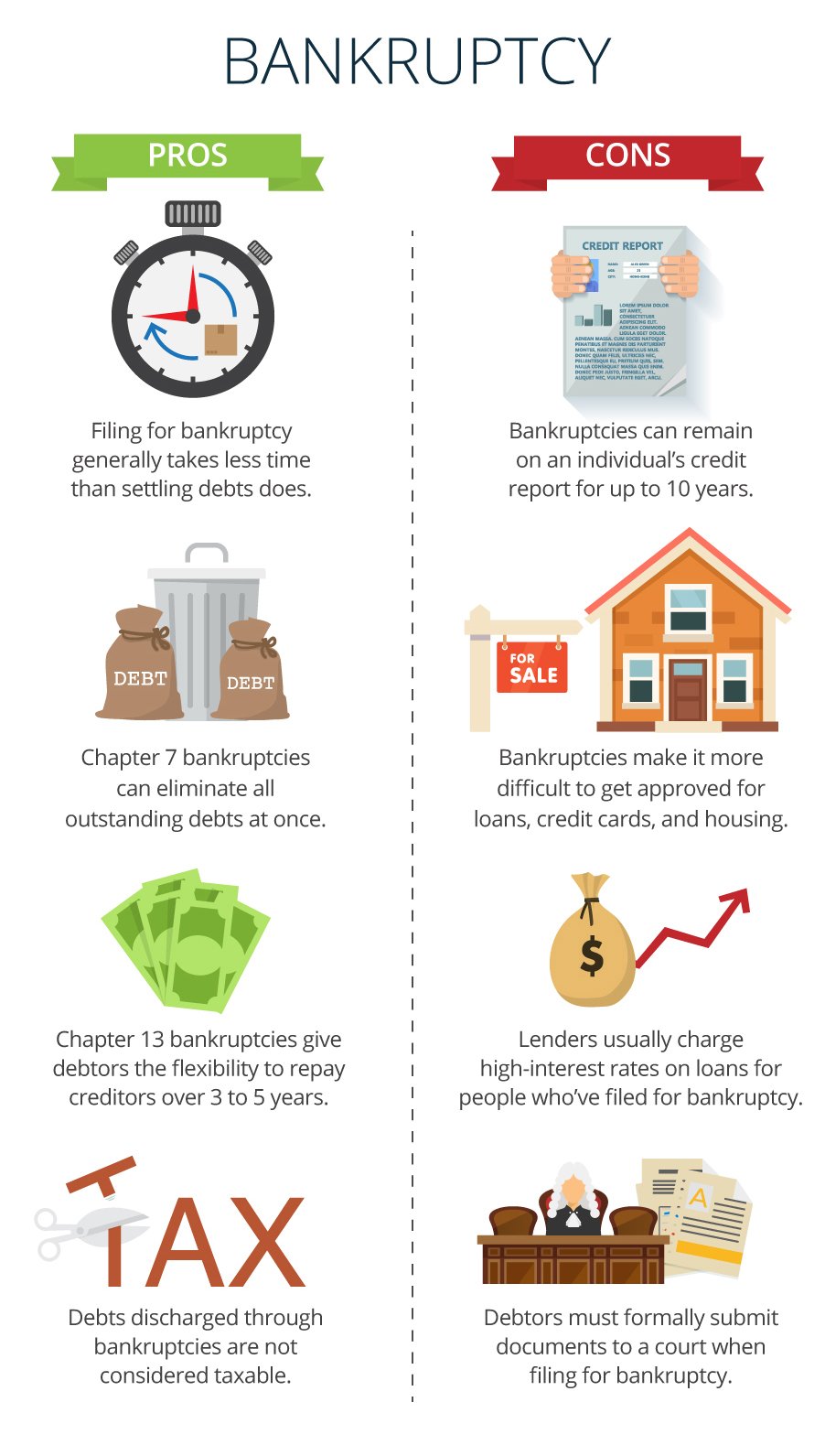

The statistics for the other major type, Chapter 13, are even worse for pro se filers. (We damage down the distinctions between both kinds in deepness below.) Suffice it to say, speak to a legal representative or more near you that's experienced with insolvency law. Here are a couple of sources to discover them: It's understandable that you could be reluctant to spend for an attorney when you're currently under substantial monetary pressure.Lots of lawyers additionally offer totally free assessments or email Q&A s. Make the most of that. (The charitable application Upsolve can help you find complimentary assessments, sources and legal help at no cost.) Ask them if personal bankruptcy is indeed the appropriate selection for your situation and whether they assume you'll qualify. Before you pay to file insolvency forms and imperfection your credit scores record for up to 10 years, inspect to see if you have any type of viable choices like financial debt arrangement or non-profit credit history therapy.

Advertisements by Money. We may be made up if you click this ad. Advertisement Since you've chosen bankruptcy is indeed the right strategy and you hopefully removed it with a lawyer you'll need to begin on the paperwork. Before you dive right into all the official personal bankruptcy types, you must get your very own documents in order.

Our Bankruptcy Law Firm Tulsa Ok PDFs

Later on down the line, you'll really require to show that by revealing all kinds of details concerning your financial affairs. Here's a basic list of what you'll need when traveling in advance: Determining records like your motorist's license and Social Safety and security card Tax obligation returns (up to the past 4 years) Evidence of revenue (pay stubs, W-2s, freelance incomes, income from possessions as well as any type of income from government advantages) Financial institution declarations and/or pension statements Proof of worth of your possessions, such as car and realty assessment.

You'll desire to comprehend what kind of financial obligation you're attempting to settle.

You'll desire to comprehend what kind of financial obligation you're attempting to settle.If your revenue is too high, you have an additional choice: Chapter 13. This alternative takes longer to resolve your debts since it requires a lasting settlement strategy generally three to five years before a few of your remaining financial debts are cleaned away. important source The declaring procedure is also a whole lot much more intricate than Phase 7.

The Definitive Guide to Tulsa Bankruptcy Filing Assistance

A Phase 7 personal bankruptcy stays on your credit history report for 10 years, whereas a Phase 13 personal bankruptcy diminishes after seven. Both have long lasting impacts on your credit report, and any type of brand-new financial debt you get will likely feature greater rates of interest. Prior to you send your insolvency forms, you have to first complete a required training course from a credit scores therapy agency that has been authorized by the Department of Justice (with the remarkable exception of filers in Alabama or North Carolina).

The course can be completed online, personally or over the phone. Training courses commonly cost between $15 and $50. You must complete the training course within 180 days of filing for personal bankruptcy (bankruptcy attorney Tulsa). Utilize the Department of Justice's web site to find a program. If you reside in Alabama or North Carolina, you must choose and finish a program from a list of individually approved providers in your state.

Indicators on Tulsa Ok Bankruptcy Attorney You Need To Know

An attorney will typically handle this for you. If you're submitting by yourself, understand that there have to do with 90 different insolvency areas. Inspect that you're filing with the proper one based on where you live. If your long-term home has actually relocated within 180 days of filling, you should file in the district where you lived the greater part of that 180-day period.

Normally, your bankruptcy lawyer will work with the trustee, yet you may require to send out the person documents such as pay stubs, income tax return, and savings account and charge card statements directly. The trustee who was simply selected to your situation will certainly quickly establish a required meeting with you, referred to as the "341 meeting" since it's a requirement of Area 341 of the U.S

You will certainly require to offer a timely list of what qualifies as an exemption. Exemptions may relate pop over to this website to non-luxury, key vehicles; required home products; and home equity (though these exemptions policies can differ commonly by state). Any home outside the listing of exemptions is taken into consideration nonexempt, and if you don't supply any kind of listing, then all your residential or commercial property is considered nonexempt, i.e.

You will certainly require to offer a timely list of what qualifies as an exemption. Exemptions may relate pop over to this website to non-luxury, key vehicles; required home products; and home equity (though these exemptions policies can differ commonly by state). Any home outside the listing of exemptions is taken into consideration nonexempt, and if you don't supply any kind of listing, then all your residential or commercial property is considered nonexempt, i.e.The trustee would not sell your cars to immediately pay off the lender. Rather, you would pay your financial institutions that amount throughout your layaway plan. A typical misunderstanding with insolvency is that once you file, you can quit paying your financial debts. While bankruptcy can aid you erase a number of your unsafe debts, such as past due clinical bills or individual finances, you'll wish to keep paying your regular monthly settlements for safe financial obligations if you wish to keep the residential or commercial property.

Getting The Chapter 13 Bankruptcy Lawyer Tulsa To Work

If you're at threat of foreclosure and have exhausted all various other financial-relief alternatives, then declaring Phase 13 may delay the foreclosure and conserve your home. Inevitably, you will certainly still need the income to proceed making future mortgage settlements, in addition to paying off any kind of late settlements throughout your payment strategy.

The audit might delay any type of financial debt alleviation by numerous weeks. That you made it this much in the procedure is a good sign at least some of your financial debts are qualified for discharge.

Report this page